Market Analysis and Straddle Adjustment Strategies (2024-09-16)

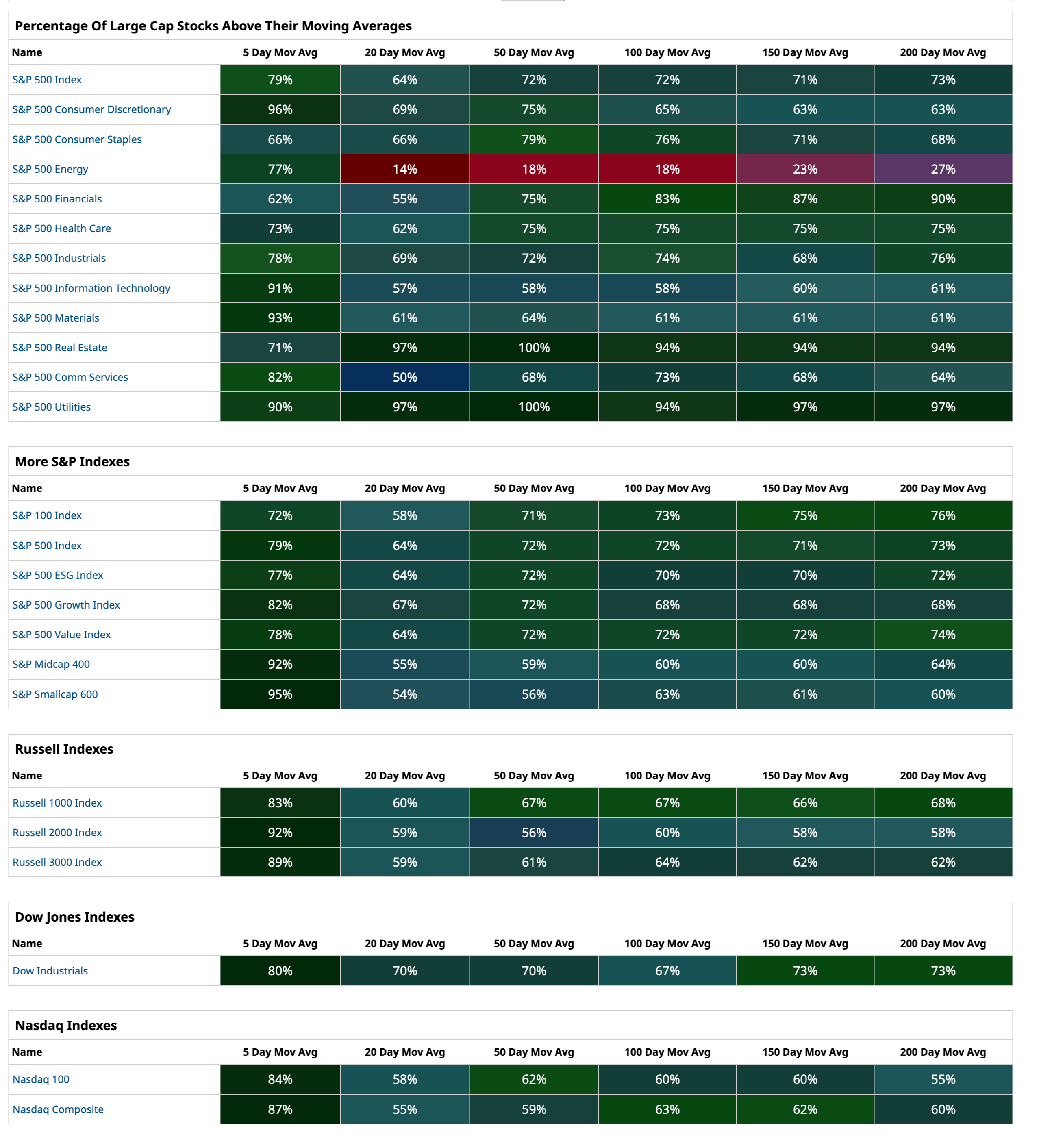

This is how the market looked yesterday:

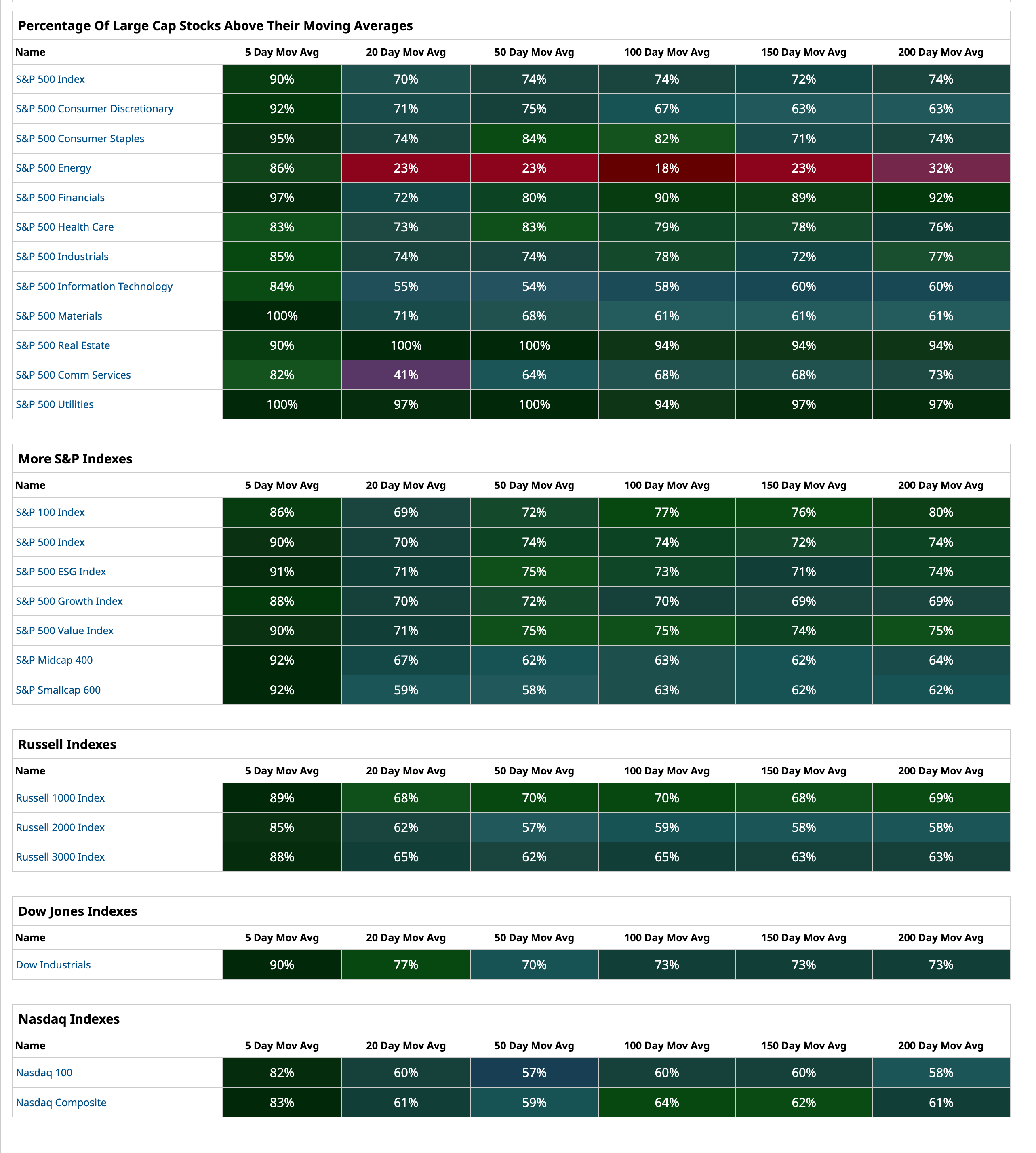

And this is how it looks today:

Existing Positions

/ESU24 Sep 16th 7DTE Short Straddle

Closed it for a scratch which was pretty good as the market moved around 5% in a week.

Closed for -$12.50 (-0.2%) return since Sep 9, 2024 at 5:51 PM

/ESU24 Sep 20th 7DTE Short Straddle

Close one straddle to reduce margin requirement and bring strike back to the middle of straddle. Looking to close this tomorrow before the FOMC announcement.

New Position

Experiments

Some trades that I’m following to learn and try out other strategies.

/ESU24 Sep 16th 2DTE Short Straddle

Closed for +$657.25 return since Sep 12, 2024, 4:10 PM

/ESU24 Sep 16th 0DTE Short Straddle (exp)

Closed for +$582.50 return since Sep 16, 2024, 3:04 PM

/ESU24 Sep 18th 2DTE Short Straddle (exp)

Almost 5% profit on the 2DTE so should close it

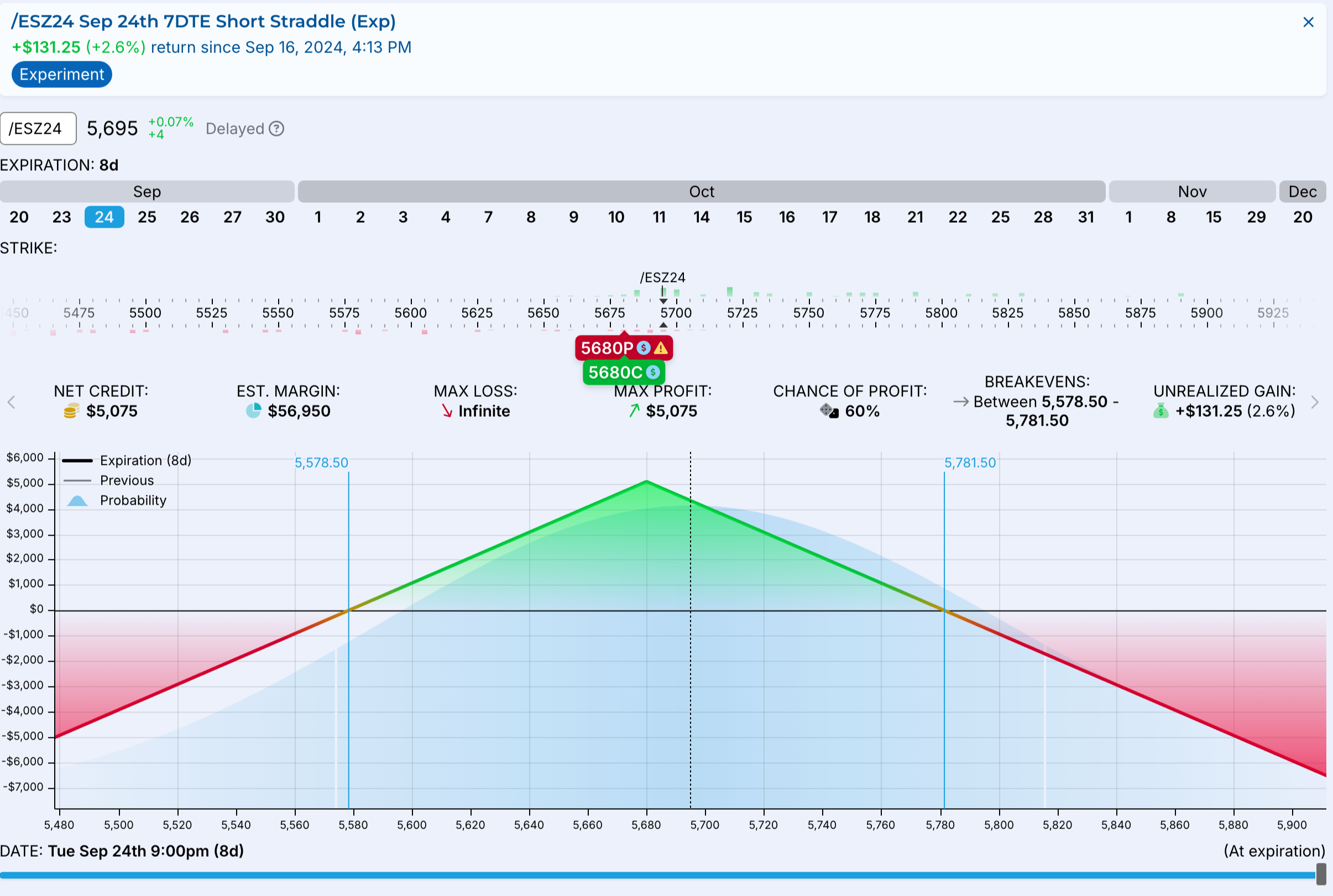

/ESZ24 Sep 24th 7DTE Short Straddle (Exp)

7DTE to watch due to FOMC announcement on the 18th. Paper trade due to extra uncertainty in the market.

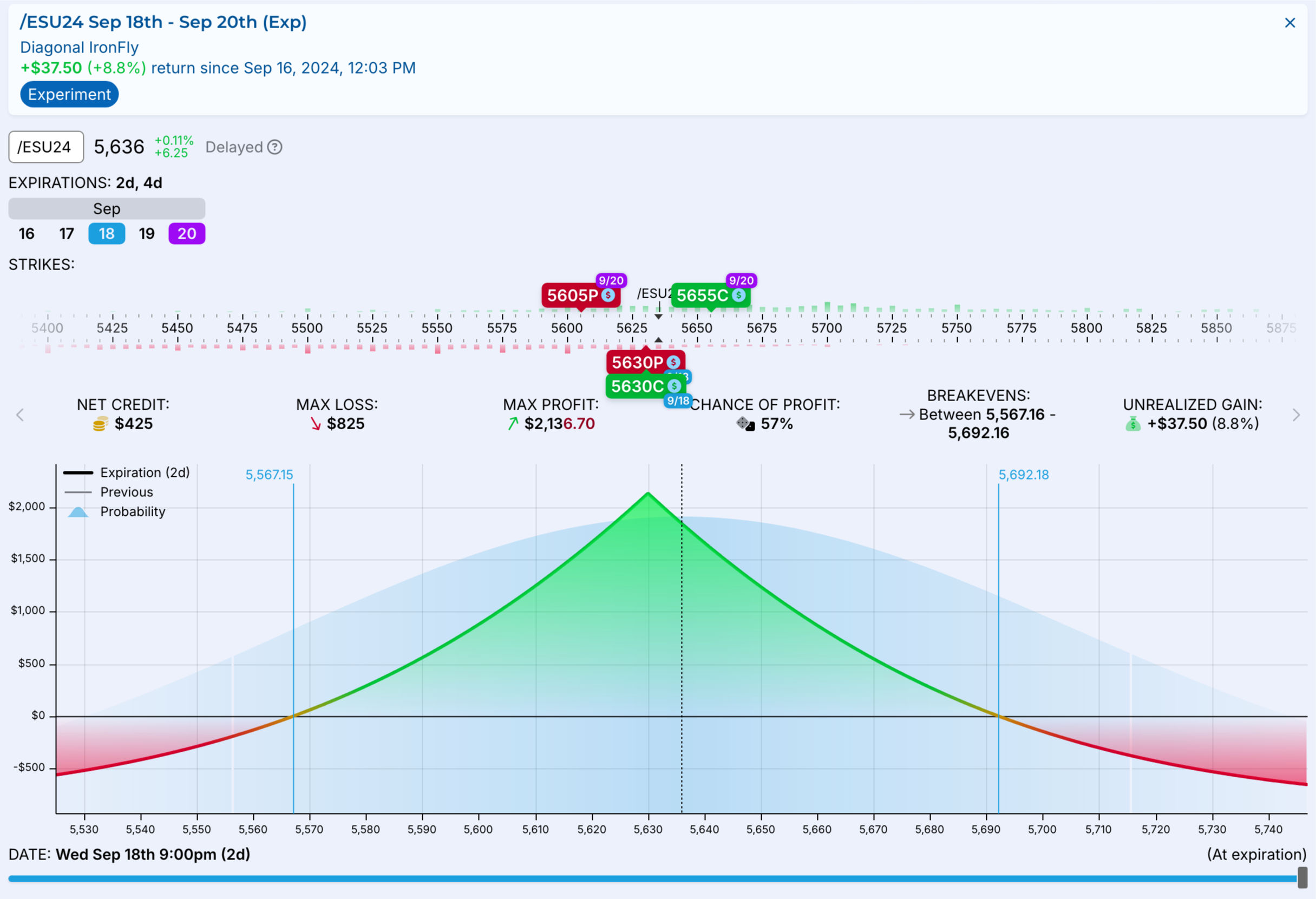

/ESU24 Sep 18th - Sep 20th (Exp)

Defined Risk trade with diagonal IronFly. It moves slow but keen to try out adjustments.