Market Analysis and Straddle Adjustment Strategies (2024-09-17)

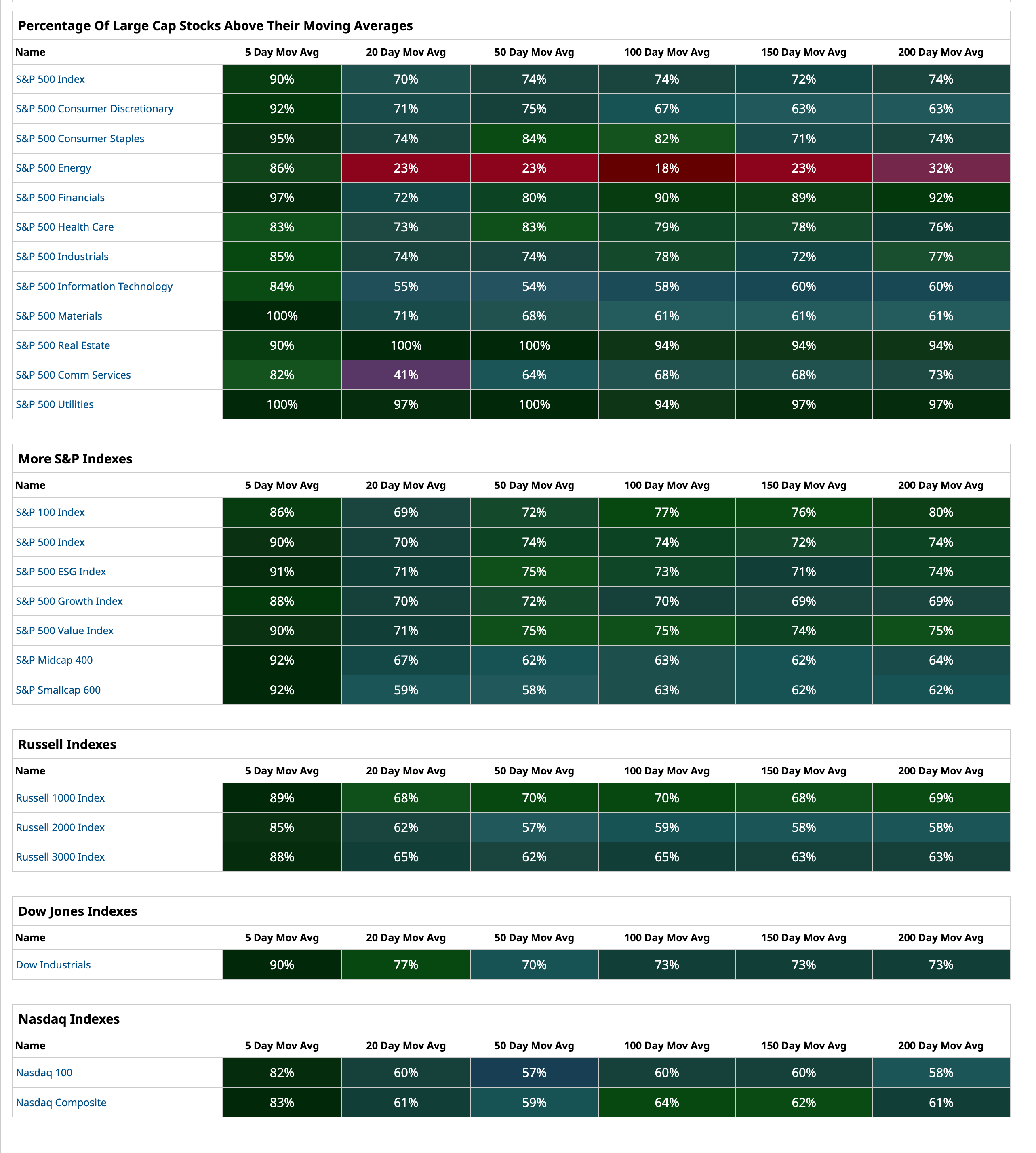

This is how the market looked yesterday:

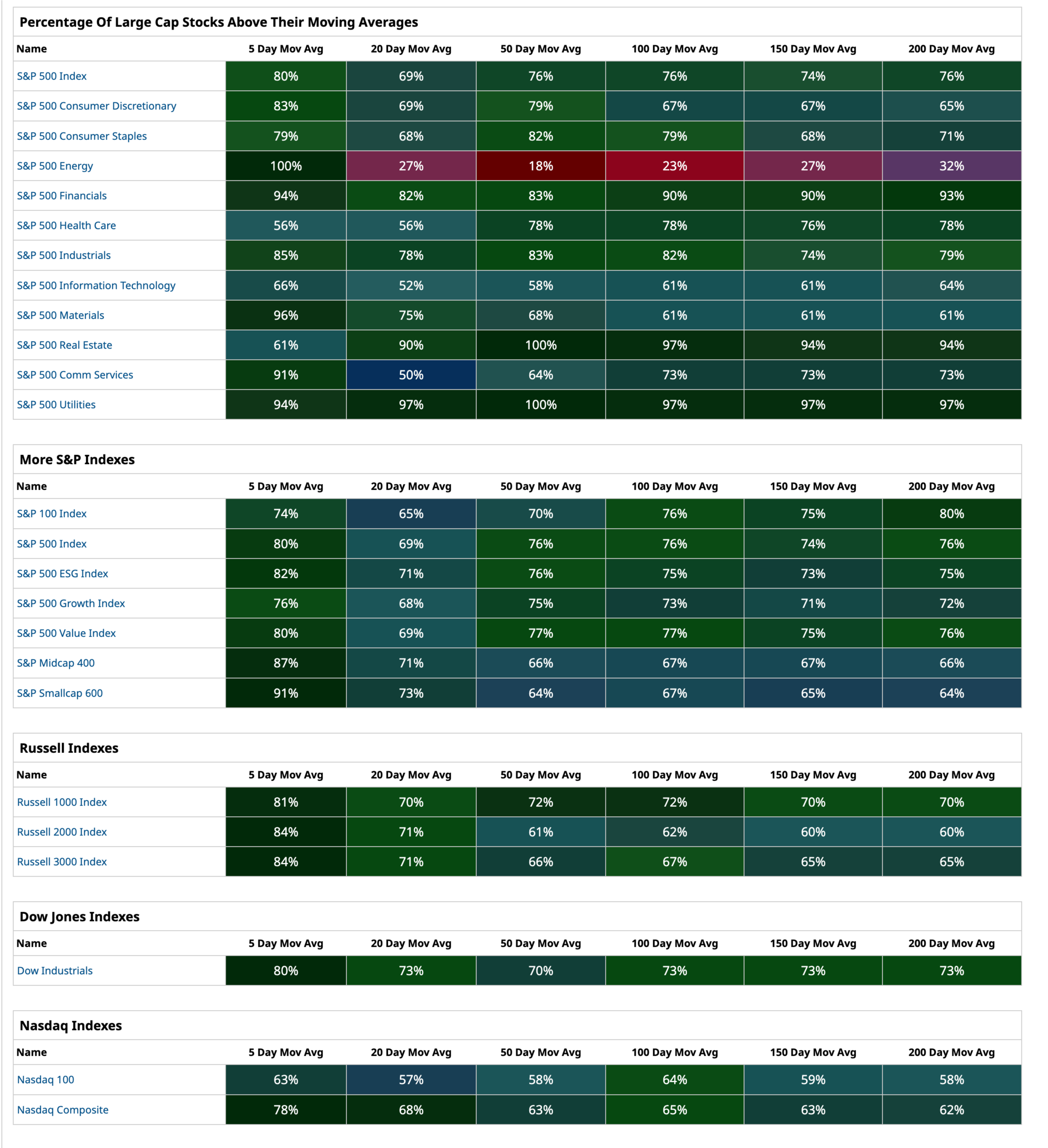

And this is how it looks today:

Existing Positions

/ESU24 Sep 20th 7DTE Short Straddle

Closed for +$825 return since Sep 12, 2024 at 6:41 PM

New Position

No news positions today due to Sept volatility and FOMC Interest rate decision.

Experiments

Some trades that I’m following to learn and try out other strategies.

0 DTE

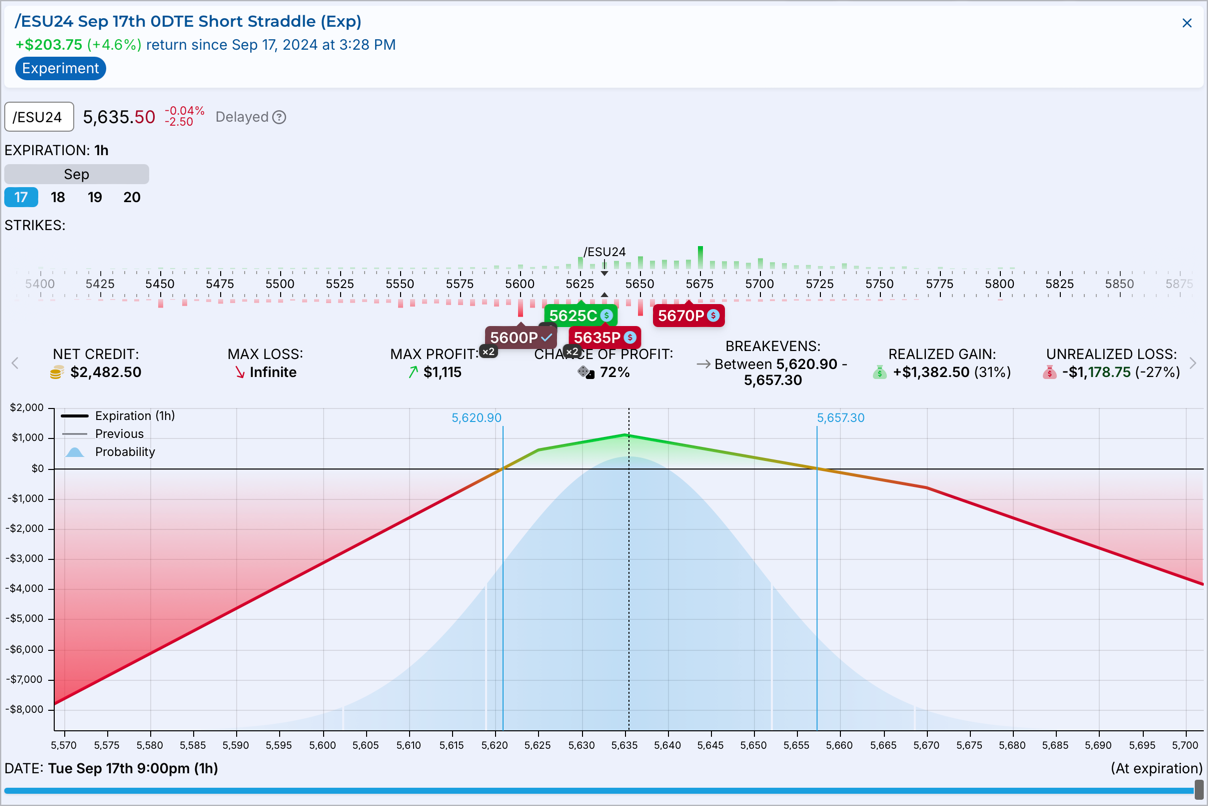

/ESU24 Sep 17th 0DTE Short Straddle (Exp)

0DTE required a couple of adjustments. Closed for +$288 return since Sep 17, 2024 at 3:28 PM

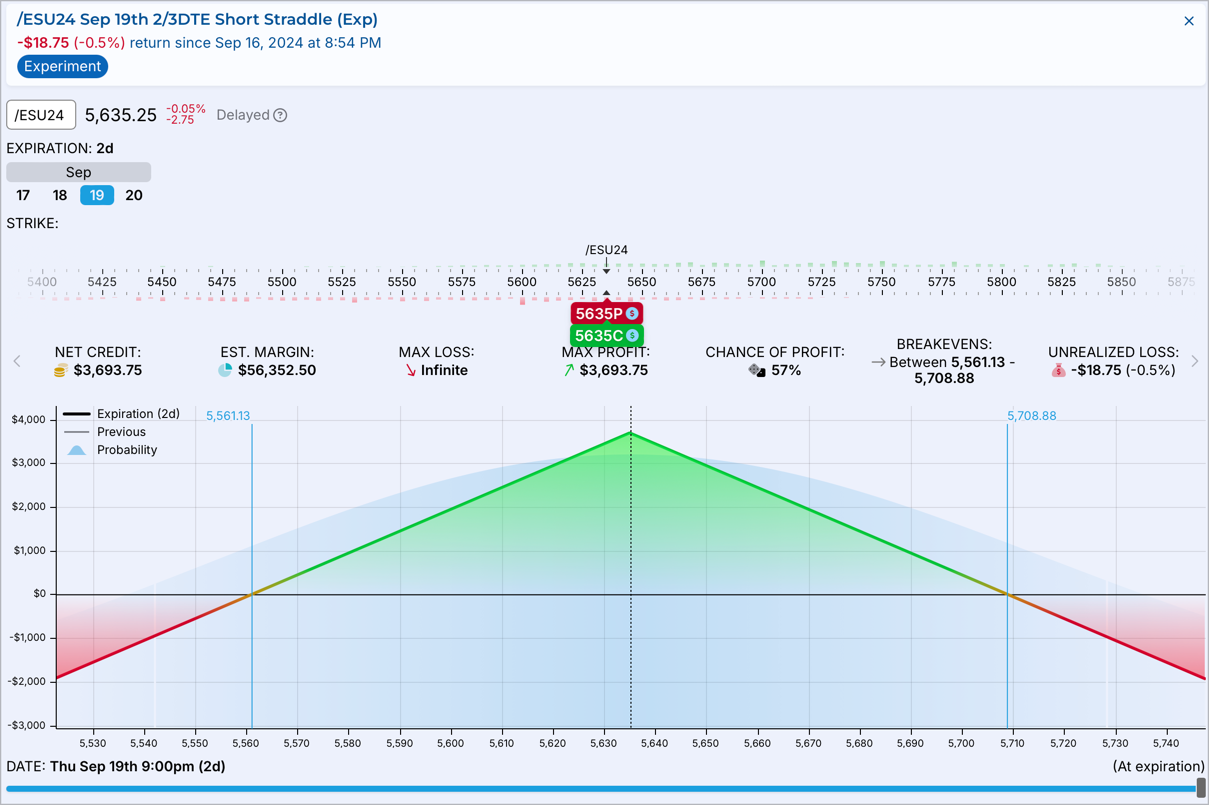

2/3 DTE

/ESU24 Sep 18th 2DTE Short Straddle (exp)

Closed for +$181 return since Sep 16, 2024 at 3:04 PM

/ESU24 Sep 19th 2/3DTE Short Straddle (Exp)

/ESU24 Sep 20th 3DTE Short Straddle (Exp)

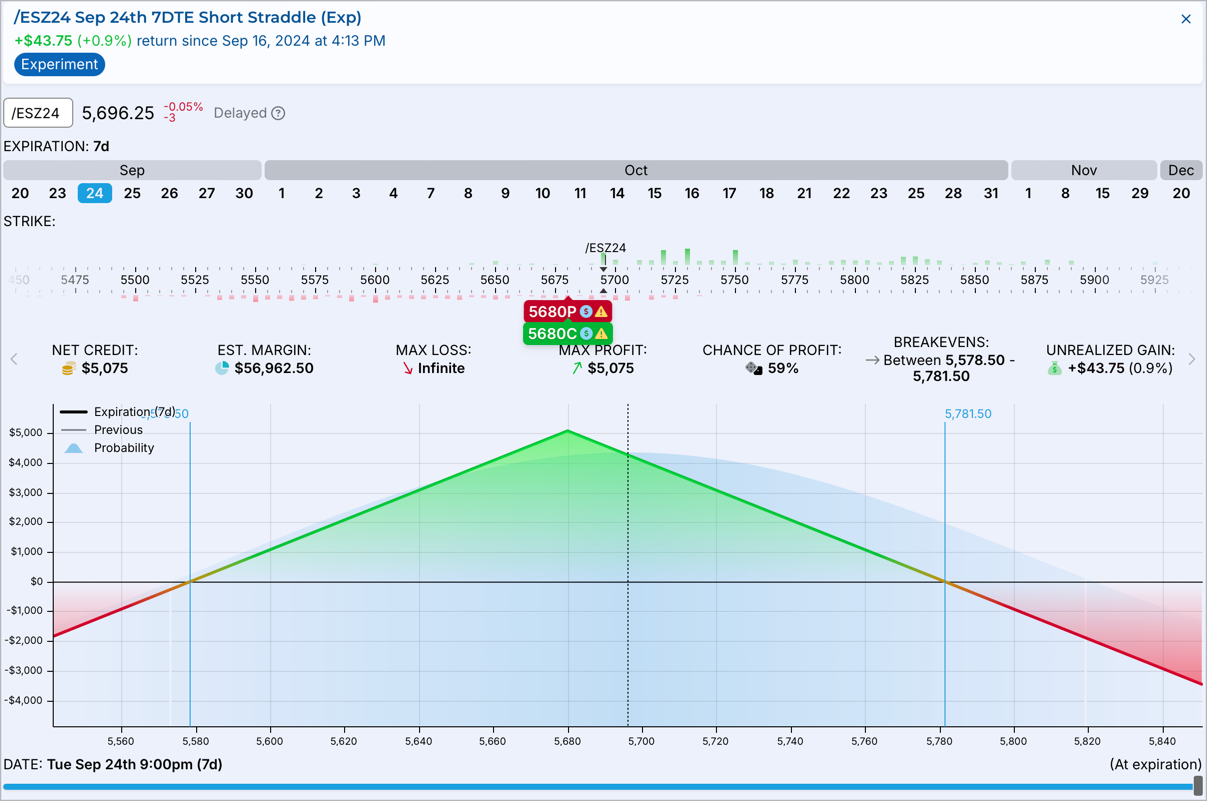

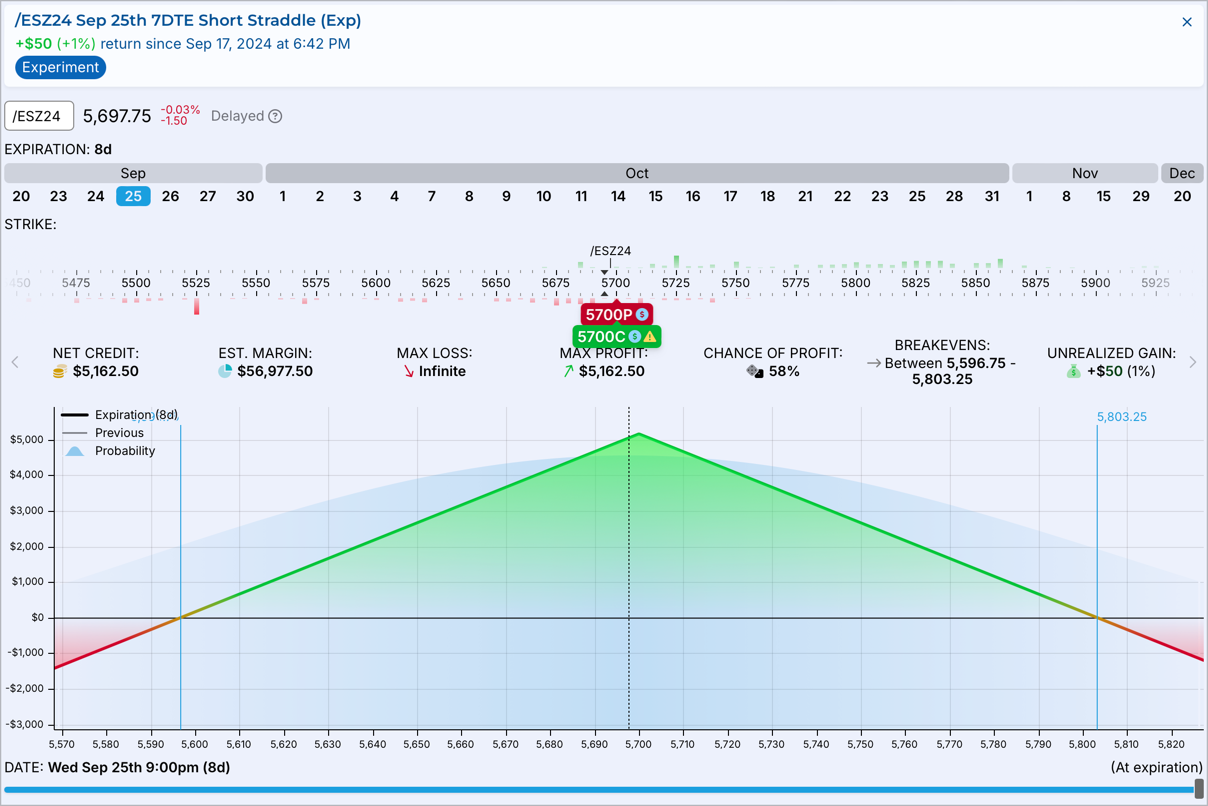

7/8 DTE

/ESZ24 Sep 24th 7DTE Short Straddle (Exp)

7DTE to watch due to FOMC announcement on the 18th. Paper trade due to extra uncertainty in the market.

/ESZ24 Sep 25th 7DTE Short Straddle (Exp)

Another 7 DTE in plans to do one straddle every day

Others

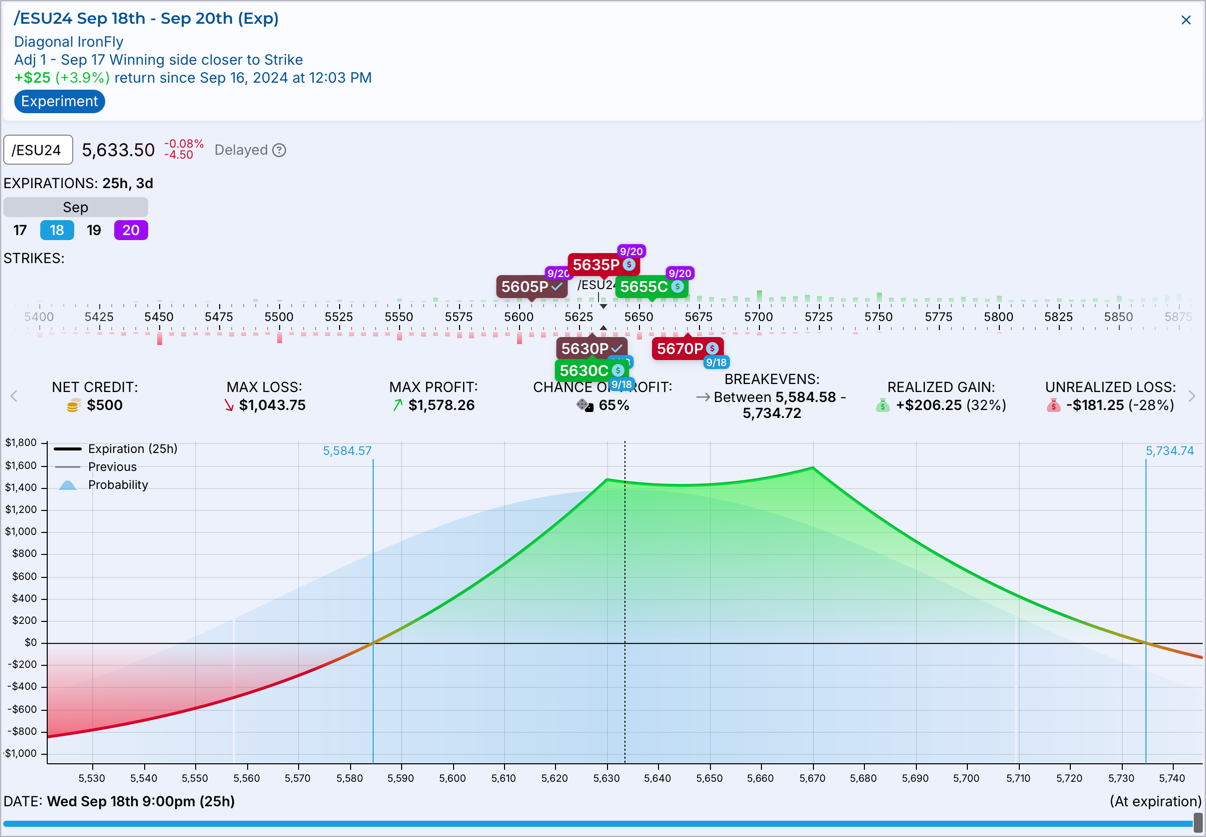

/ESU24 Sep 18th - Sep 20th (Exp)

Defined Risk trade with diagonal IronFly. It moves slow but keen to try out adjustments. Adjustment to roll the winning side (Puts) up